|

The need for Model Risk Management (MRM) Organisations are making major investments today to harness their massive and rapidly growing quantities of information. They are putting existing data to work and building better models with greater predictive power by applying advanced tools and techniques like Machine Learning (ML) and Artificial Intelligence (AI). Models are now critical, if not central, to business. Particularly in financial services which finds itself under ever increasing scrutiny. Model Governance therefore is key to maintaining control in an ever evolving regulatory landscape. However, it’s clear that for organisations to get maximum value from this type of investment they need to rethink and fine-tune their strategies. In many instances, this will also mean changing their culture and processes to deliver the control and governance needed by both Regulation and good business management. To help accomplish these goals, there needs to be a combination of advanced analytics along with a deep understanding of how to apply the correct Model Risk Management (MRM) framework that suits the business and the industry sector it’s in. Where can we use Model Risk Management? There are many processes across an organisation that fit the definition of a Model. A widely accepted identification of a model is: ’Any process which consists of Input, Calculation Throughput and an Output that drives key decision making process for the business.’ Here are some specific areas where advanced analytics and MRM are commonly used:

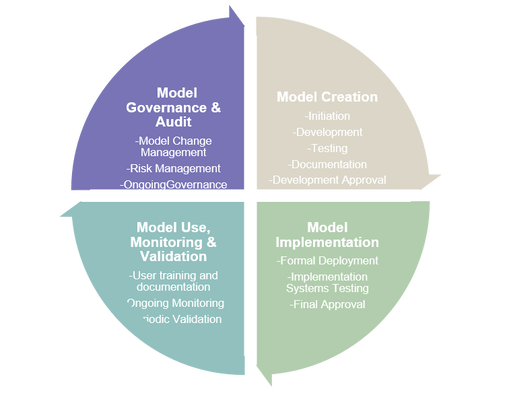

Analytics can be used at each stage of a model’s lifecycle as outlined below. Advanced Analytics and Model Risk Management Models have long been part of the toolkit used by the financial community to assess, price, and manage the various risks they face. Yet, they are also an emerging risk factor in themselves as model failure, or misuse, can seriously damage the finances, reputations, and even the solvency of firms. In addition to individual model failure, many models use the output of other models as input (e.g., a portfolio model could use modelled probability of default as input). As a result, small errors in one model might be compounded or amplified when their erroneous results are fed into other models. To mitigate this model risk, an organisation must develop and implement a suitable MRM and Model Governance framework. These governance control mechanisms are separated and outlined below to show each stage of the model lifecycle:

Figure 1 – Key Model Lifecycle Stages Model Testing and Validation – a critical area for Advanced Analytics Testing and validation are critical parts for both the development and ultimate acceptance of a model by both the business lines using the model and the external regulators that will have to review the models. Model testing and validation teams should be independent from model development teams. Three Lines of Defence Typically the Three Line of Defence (3LOD) technique is used to structure the teams, with Model Developers usually being 1LOD and Model Testers & Validations being 2LOD. Key stakeholders and model sponsors occupy the 3LOD slot. Using advanced analytics skills, model testers and validators should be in a position to challenge model developers on a regular basis. In particular, the analysis should look at all aspects of a model including inputs, analytics, reporting, and performance. Where and when needed, they should have the power to be able to prevent a model that doesn’t pass their criteria from being utilised by the institution. Testing and validation should focus on three key areas:

As already identified, sophisticated models are critically important to the success of financial institutions and fair treatment of their customers. But improperly managed and monitored, they can be dangerous to any business. Accurate control of the process and ongoing governance is key to ensuring regulatory compliance and continued business success. In my next article, I will outline the correct overview of the essential building blocks for an effective MRM framework including the importance of having a standardised model tiering procedure. If you wish to discuss any of the points raised or are interested in finding out how we can help you review or implement your own MRM and Model Governance framework, please contact us here to book your free Discovery consultation. Sources: McKinsey - advanced analytics and how it helps business functions Moody’s – the need for MRM PWC - MRM Brendan JayagopalFounder and Managing Director. Blue Label Consulting

0 Comments

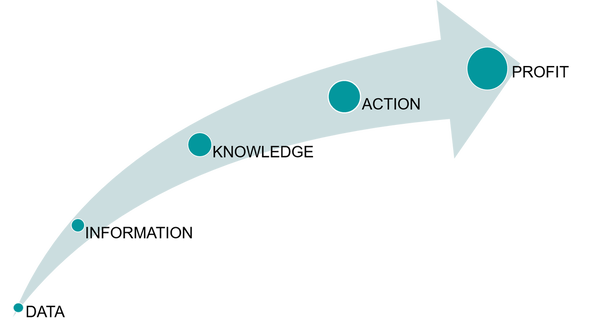

Model Risk Management (MRM) and How to Stay in Control Organisations are making major investments today to harness their massive and rapidly growing quantities of information. They are putting existing data to work and building better models with greater predictive power by applying advanced tools and techniques like Machine Learning (ML) and Artificial Intelligence (AI). Models are now critical, if not central, to business. Particularly in financial services which finds itself under ever increasing scrutiny. Model Governance therefore is key to maintaining control in an ever evolving regulatory landscape. These investments in data and models are proving vital in improving risk management in almost every major financial institution and indeed anywhere you have decision making driven by models. So why isn’t everybody managing their models effectively and why is it important to do so? The Growing Importance of MRM and Model Governance Keeping on top of every model, its performance, inputs and outputs, version control, audit trail and its use in other models, has become an increasing risk factor. As well as having a potentially detrimental impact on customers, model failure or misuse can seriously damage the finances, reputations, and even the solvency of firms. To mitigate this model risk, an organisation must develop and implement a suitable MRM and Model Governance framework to cover: Today there are few major financial institutions that don’t have some form of MRM and model governance in place. However, these are often either costly solutions developed and managed by external providers that only the big players can afford, or are managed with an in-house Excel solution, which will gradually lose its ability to cater for the increasing quantity and sophistication of models. For the largest institutions, perhaps this is OK as they are used to paying more for perceived better quality, security and expertise. However for Tier 2 banks and financial institutions, finding a way to manage the increasing model governance burden is fast becoming a critical issue. Fit for Purpose? The questions you need to answer for yourself are whether your business has a suitable MRM and Model Governance framework in place and if not, how do you develop one that is suitable for you with confidence and without excessive costs? In other words, how can you move from a partly manual operation with spreadsheets, to a fully automated solution that doesn’t cost the earth? In the New Year I will be releasing a series of articles focused on this important topic, looking at the various stages and processes you need to put in place to control this increasingly important aspect of your business. If you are interested in finding out more or understanding how we can help you review or implement your own MRM and Model Governance framework, please contact us here to book your free Discovery consultation. Brendan JayagopalFounder and Managing Director. Blue Label Consulting Driving Change and Sustainable Growth Over the course of this series, we have looked at how businesses can align their Data Analytics capabilities with business outcomes to drive Growth across a number of different areas. This is important as the Vehicle Leasing sector moves from the current downturn, to testing the market, to full on growth with a greater degree of certainty, safety and profitability. Data for Competitive Advantage Initially we looked at how data analytics can be a source of real competitive advantage particularly as you move away from over reliance on generic industry data and focus on the benefits of internal and proprietary data. I also talk briefly about this here - https://vimeo.com/423172464 In addition, speed is key in being able to access to the data, discover the insights and execute the strategy to get ahead of the competition. Managing Risk in Uncertain Times We also acknowledged that in these strange times – for Vehicle Leasing in particular – managing Risk becomes perhaps the most important aspect in your business (if it’s not already). As you look to open your doors to new business again, it’s important to develop your own credit scorecards based on customer performance rather than accessing generic scorecards. A more nuanced approach to assessing risk enables you to better inform new business underwriting as well as customer and arrears management strategies. Using your own data is also beneficial in setting Residual Values (RV), as was proven recently when we applied machine learning to a leasing client’s own historical sales data. Not only did the model identify and quantify pertinent RV risk drivers, it also gave them an empirical basis to challenge industry and manufacturer forecasts. Governance and Oversight Not the most exciting of topics, however this is a critical focus for companies in any form of financial services - or it should be. Having oversight of commercial performance and how sales are being achieved is clearly important for sales management, but equally, leasing companies need a method of safeguarding compliance by flagging up potential risks through comparative analysis across their Associate networks. Using data to oversee performance and pick up trends provides early warnings and helps ensure effective governance and management of the sales process across multiple outlets and channels across the network. New Business and Product Development As we come out the downturn and once again look to grow the business at pace, we need to be cognisant of the changes that have occurred. These may be minor changes or more fundamental ones such as customer behaviour, needs or circumstances. It is important that we understand how these impact the business and product offering. Employing analytics and machine learning techniques can reveal different segments and opportunities in your customer base and/or market place. This analysis can then be used to create more intelligently designed products and deliver them successfully to the target segments. Having the data and analytics capability to quickly identify these trends and then deriving actionable insight and acting on it will enable you to target your product development and sales and marketing activity more effectively and provide you with a stronger base for growth. Telematics For some Vehicle Leasing companies that also do insurance, Telematics data adds a whole new dimension to the risk assessment process, which leads to better pricing of premiums and increased profitability. Leasing companies that offer fleet management products or services on a consultancy basis can use the telematics data to help their clients’ own fleet managers achieve enhanced operational benefits. Doing more with Telematics data is a great way to gain competitive advantage so if you are not already doing it, you should. If you are, then are you doing all that you could to realise its full potential? Data as an Asset The key to pivoting your business for sustainable growth is to see Data as a mission critical business Asset. To get the most out of it, you need to invest in the data infrastructure and the teams that can extract actionable insight at pace. Businesses that have planned for different eventualities and used robust and comprehensive data analytics to make rapid, intelligent decisions and execute at pace will be best placed to survive and thrive beyond this crisis. Don’t get left behind. Take this opportunity to determine how to get the most out of your data assets whether that be through your own teams, accessing expert advice and support or a combination of both. In these difficult times, it is even more important to determine how to leverage your data to help you move to full on growth with certainty, safety and profitability. So What's Next? Having outlined how organisations can align their Data and Analytics capabilities with business outcomes to drive Growth across different areas, there are a number of steps you should take now in order to build resilience and prepare for recovery. If you haven't already, start by reviewing the data and models used to inform key business decisions. Prioritise by importance and materiality then work your way down the list, reviewing aspects such as:

Start researching how you can use additional and/or alternative data sources to improve existing models and build new ones. If you're not already, you need to capitalise on transactional data to give you a more granular understanding of customer behaviour. Can you create more proprietary data by combining internal/external data with data that your business generates? If you can, you should also undertake some form of sentiment analysis e.g. using social media data where appropriate. Also, make sure you consider how digital transformation can impact your business both in terms of opportunities as well as risks such as fraud or data security. It is estimated that this crisis has accelerated digital transformation by 7 years! So if you've not already done it, you soon will and you'll need to be ready for it. Recognise Opportunities and Adapt Finally, keep in mind that this is not just about avoiding risk but also about recognising opportunities and adapting quickly. Therefore, it's also crucial to be aware of technical and system implications of the data and models you wish to develop and deploy as well as the ability of your systems and people to support the strategy you wish to execute. Remember that more often than not, speed of execution is key and this will determine the winners and losers emerging from this crisis. If you are interested in finding out more about how we can help you to build resilience in these uncertain times and position your business for growth, please contact us here to book your free Discovery consultation. Blue Label Consulting Approach An independent Data Science and Analytics consultancy operating in Vehicle Leasing and Financial Services, Blue Label Consulting delivers valuable, actionable and strategic insight while making knowledge transfer to your team a priority. Whether in Asset Risk or Credit Risk, Segmentation and Customer Insight or Governance and Oversight, we can help you solve your data related business challenges and help your data teams become self-sufficient in the long run. Brendan JayagopalFounder & Managing Director. Blue Label Consulting Gaining Traction and Value from Telematics data  In this series, I have deliberately kept the subject areas general. However, I believe that there are opportunities within the vehicle leasing industry to gain more traction and value from Telematics data than is currently being achieved. This becomes even more important now as we look to move out of a difficult period for businesses and customers alike. Amongst a wealth of data, Telematics also provides information about driving behaviour and habits. This data can enable insurers to both manage existing risk and develop the next generation of insurance risk and pricing models. It helps drive behavioural changes among users and enables insurers to create not only pay-as-you-drive but also pay-how-you-drive premium calculations. This in turn leads to better understanding and management of risk as well as reduced premiums for good drivers. Monetising the data Driver data can also be monetised and repurposed in other ways, such as:

Diversifying risk By charging premiums in exchange for cover, insurers can reinvest profits into other assets thus diversifying their risk even further. For example road safety training, fuel efficient driving – especially useful for large fleets, hazard perception and RTA (road traffic accident) training (basic first aid skills, first response checklist for those encountering an RTA). For vehicle leasing companies that also do insurance, this adds a whole new dimension to the risk assessment process, which leads to better pricing of premiums and increased profitability while enhancing the customer experience and building brand loyalty in the process. Leasing companies that offer fleet management products or services on a consultancy basis can also use Telematics data to help their clients’ own fleet managers achieve enhanced operational benefits. A Telematics based model adds more data than just the traditional style models. With the addition of Telematics data, machine learning techniques can be used to estimate the frequency and severity of claims for more targeted insurance products and competitive pricing without cannibalising profitability. Just do it Doing more with Telematics data is a great way to gain competitive advantage so if you are not already doing it, you should. If you are, then are you doing all that you could with it and realising its full potential? The final part of this series will recap the benefits of a strong analytics capability. When a business sees Data as a mission critical business Asset, the impact on growth, risk and compliance cannot be overstated. If you are interested in finding out more about extracting value from your Telematics data please contact us here to book your free Discovery consultation. Brendan JayagopalFounder & Managing Director. Blue Label Consulting |

brendan jayagopalBrendan launched Blue Label Consulting in 2011. With innovative use of Data through emerging data sciences such as AI and other quantitative methods, he delivers robust analytics and actionable insights to solve business problems. Archives

February 2021

Categories

All

|

Our Services |

Our Clients |

|

RSS Feed

RSS Feed