|

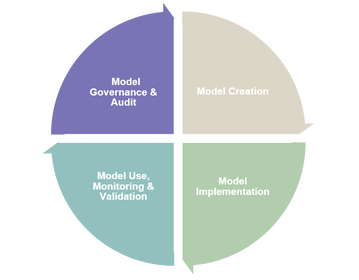

Model Risk Management (MRM) and How to Stay in Control Organisations are making major investments today to harness their massive and rapidly growing quantities of information. They are putting existing data to work and building better models with greater predictive power by applying advanced tools and techniques like Machine Learning (ML) and Artificial Intelligence (AI). Models are now critical, if not central, to business. Particularly in financial services which finds itself under ever increasing scrutiny. Model Governance therefore is key to maintaining control in an ever evolving regulatory landscape. These investments in data and models are proving vital in improving risk management in almost every major financial institution and indeed anywhere you have decision making driven by models. So why isn’t everybody managing their models effectively and why is it important to do so? The Growing Importance of MRM and Model Governance Keeping on top of every model, its performance, inputs and outputs, version control, audit trail and its use in other models, has become an increasing risk factor. As well as having a potentially detrimental impact on customers, model failure or misuse can seriously damage the finances, reputations, and even the solvency of firms. To mitigate this model risk, an organisation must develop and implement a suitable MRM and Model Governance framework to cover: Today there are few major financial institutions that don’t have some form of MRM and model governance in place. However, these are often either costly solutions developed and managed by external providers that only the big players can afford, or are managed with an in-house Excel solution, which will gradually lose its ability to cater for the increasing quantity and sophistication of models. For the largest institutions, perhaps this is OK as they are used to paying more for perceived better quality, security and expertise. However for Tier 2 banks and financial institutions, finding a way to manage the increasing model governance burden is fast becoming a critical issue. Fit for Purpose? The questions you need to answer for yourself are whether your business has a suitable MRM and Model Governance framework in place and if not, how do you develop one that is suitable for you with confidence and without excessive costs? In other words, how can you move from a partly manual operation with spreadsheets, to a fully automated solution that doesn’t cost the earth? In the New Year I will be releasing a series of articles focused on this important topic, looking at the various stages and processes you need to put in place to control this increasingly important aspect of your business. If you are interested in finding out more or understanding how we can help you review or implement your own MRM and Model Governance framework, please contact us here to book your free Discovery consultation. Brendan JayagopalFounder and Managing Director. Blue Label Consulting

0 Comments

|

brendan jayagopalBrendan launched Blue Label Consulting in 2011. With innovative use of Data through emerging data sciences such as AI and other quantitative methods, he delivers robust analytics and actionable insights to solve business problems. Archives

February 2021

Categories

All

|

Our Services |

Our Clients |

|

RSS Feed

RSS Feed