|

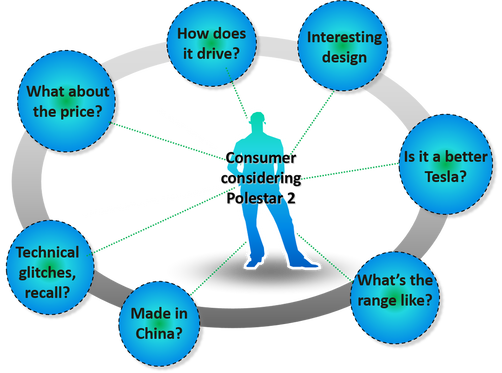

There has been some talk lately about the Polestar 2 and whether it is a credible threat to the Tesla Model 3. As such, I thought I would apply NLP to undertake sentiment analysis on social media feeds to see what real people were saying about it rather than just relying on automotive magazine reviews or the opinion of a few individuals. But first, what is NLP and what is sentiment analysis? NLP or Natural Language Processing can be said to be a subfield of linguistics, computer science and Artificial Intelligence (AI) concerned with the interactions between computers and human language. In particular, how to program computers to process and analyse large amounts of natural language data. Sentiment analysis in simple terms is the use of NLP, text analysis, computational linguistics and biometrics to systematically identify, positive or negative sentiment in free text data. Background to the analysis The Polestar 2 is a new electric car developed by Polestar, a standalone electric offshoot jointly owned by Volvo and its Chinese parent company, Geely. As the flagship product, this is attempting to establish Polestar as a big player in the Electric Vehicle (EV) space and is seen as a direct competitor to the Tesla Model 3. Key questions Vehicle Leasing companies might ask With the drive to electrification gathering pace, I assumed vehicle leasing companies might be keen to know what potential customers are saying about the Polestar 2 and what the implications might be for their business.

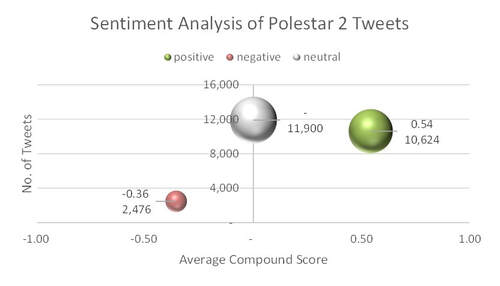

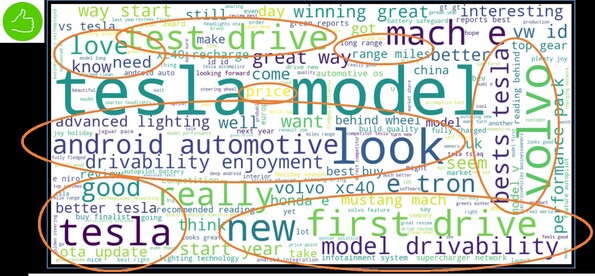

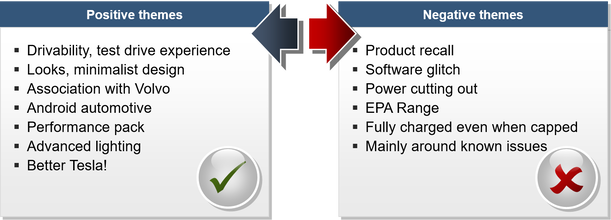

In order to answer these questions, I performed sentiment analysis on a total of 25,000 English tweets related to “Polestar 2”. These were classified as positive, negative or neutral sentiment. I then used word visualisation to bring this to life. Technical stuff I used a range of packages to perform this analysis in Python including Twint to extract tweets, WordCloud for word visualisation and NLTK to clean text (remove stopwords, tokenizing, lemmatizing). And to classify tweets as positive, negative or neutral sentiment I used VADER (Valence Aware Dictionary and sEntiment Reasoner), which performs lexicon and rule based sentiment analysis and is specifically tuned to social media conversations. Based on the actual words used in these tweets, a Compound Score is calculated and assigned to each tweet, ranging from -1 (most negative) to +1 (most positive). Why sentiment analysis is important, particularly on social media Social media conversations provide a wealth of data to help brands understand who is out there, what they’re talking about and what's important to them. And best of all, these are real time conversations! Of the 25,000 tweets, 48% were neutral. With these neutral tweets excluded, the remaining tweets are overwhelmingly positive (81%). In addition, positive tweets are more positive than negative tweets are negative. This has been visualised in the bubble plot below whereby the green bubble representing positive tweets is clearly larger and more to the right, whereas the red bubble representing negative tweets is clearly smaller and not as much to the left. Word visualisation The positive and negative Word visualisations below reveal the themes being discussed in the positive and negative tweets respectively. NOTE: These Word clouds are based on actual tweets. The larger the words, the more frequently they appear in tweets. Themes The positive and negative themes distilled from the analysis are summarised below. Part of the original question raised was whether Tesla should be concerned about the Polestar 2 being a credible threat to the Tesla Model 3. In short, the answer is yes. The positive themes from consumer conversations far outweigh the negatives and the comment ‘better Tesla’ is an interesting one. The negative themes are mainly around known technical issues and these will surely be resolved by the manufacturer sooner rather than later. Value of the approach From this, the value of sentiment analysis on social media conversations is clear. This can be accessed by just about any business to see what their customers or prospects are saying about their brand or products and that of their closest competitors too. Indeed, this approach could be used on a variety of conversational or text data across multiple social channels as well as review sites such as TrustPilot. In essence, if you want to have direct access to consumer conversations about your brand or product and be able to monitor and react to consumer conversations in real time, then this is an area worth exploring. It gives you unfettered access to what is effectively your very own large scale focus group, available on-demand. To harness the power of NLP and sentiment analysis for your brand, please email [email protected] to request your free Discovery consultation where we'll discuss your requirements and formulate a solution that is right for you. Brendan JayagopalFounder & Managing Director. Blue Label Consulting

1 Comment

After months of restrictions, many businesses are trying to determine how to return to growth after battening down the hatches for so long. But where do you start? What is it that now makes your business vulnerable and how do you place your business on a competitive footing going forward?  While I hate the phrase ‘new normal’, it is clear that almost every business has been taking stock of where they are financially, operationally and competitively. But once you have an understanding of your situation and the broader market dynamics, what next? Each business has reacted differently to changes in the market with many having limited or even stopped sales activity. And to determine how to turn the situation around you need to know what changes have occurred.

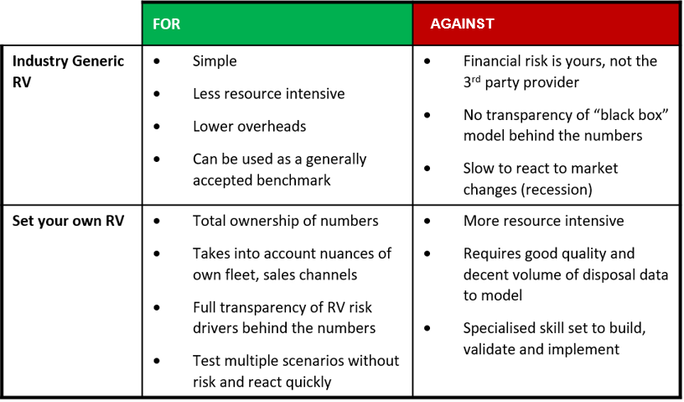

Identifying opportunities As you look to go beyond the basics of opening up your sales and marketing operations, you should look to your Analytics teams for guidance. Ask them to provide the data and insight needed to expand activities profitably and to determine where new market and product opportunities are that perhaps weren’t around or strategically important before. Have new markets or segments opened up that you can serve with your current product offering and operational capabilities? What difficulties are the competition facing (or indeed threats to yourselves) that you can identify and react to? There may even be consolidation in the industry, which could lead to opportunities to acquire competitors’ assets to rapidly grow market share. Employing machine learning techniques can reveal different segments and opportunities in your customer base and/or market place. This analysis can then be used to create more intelligently designed products and deliver them successfully to your target segments. This holds true for new customer acquisition as well as customer retention and yield management of your own customer base. Can your data analytics team identify any new or underserved segments that with a little thought around your product design, you could quickly access and grow market share? As post crisis markets continue to re-baseline, the structure of products is also likely to drastically change and vehicle leasing companies need to recalibrate to this new baseline. As an example, could subscription based products appeal to more consumers than before? A segmentation exercise could determine this by identifying the profile, needs and expectations of customers allowing you to create new product characteristics such as:

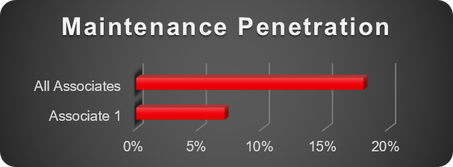

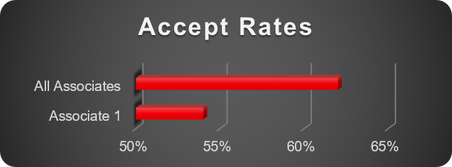

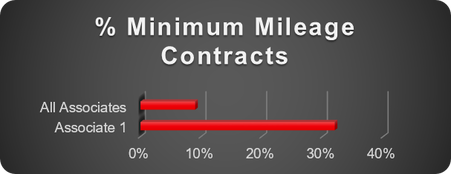

Having the data and analytics capability to identify these segments and then deriving actionable insight to capitalise on the underlying trends will enable you to target your product development and sales and marketing activity more effectively and provide you with a stronger base for growth. The next part of this series will talk more specifically about Telematics opportunities. If you want to know how to use data analytics for sustainable growth in the current climate and beyond, please contact us here to book your free Discovery consultation. Brendan JayagopalFounder & Managing Director. Blue Label Consulting.  Governance and Oversight Governance and Oversight, or compliance if you will. Not the most exciting of topics and not immediately obvious as a data analytics subject matter. However, it is a critical focus across the financial services industry and so it should be in the Vehicle Leasing sector. So how can we use data analytics to help ensure that we have oversight across the business and third parties as appropriate? And why is this important? In order to bring this to life, I will use an example focussing on third party associate (broker/dealer) oversight. Having a clear view of commercial performance and how it is being achieved is vitally important for sales management. Equally, leasing companies need a method of ensuring compliant sales and flagging up potential risks through comparative analysis across their Associate channel. Identifying the data requirements is therefore as important as pulling it together into a visual and accessible format for stakeholders to self-serve. The areas of oversight we need to look at therefore include: Commercial performance Key metrics monitored include tracking against sales targets, tactical sales, early terminations, penetration of add on services, contribution, as well as commission and VRB. Monitoring these metrics informs the respective account managers of conversations they might need to be having with their associates. For instance, if a given associate is overly reliant on tactical sales or not selling enough add on services, such as shown by “Associate 1” below, whose maintenance penetration is about a third that of the entire Associate channel. These metrics could be used to decide on which levers to pull to influence Associate behaviour e.g. offering better VRB terms, increased sales support if over reliant on tactical sales or better commission. Responsible lending Credit quality of customers put forward by Associates has to be closely monitored to determine the quality of their credit decisioning process, including affordability assessments. Does every Associate undertake the necessary checks to pre-qualify a customer to see if they can afford the monthly rentals and are credit worthy? For example, the Accept rate of “Associate 1” in the chart below is markedly lower than that of the Associate channel average. This low accept rate could indicate that they are not doing enough to pre-qualify prospective customers before submission. Coupled with a high refer rate, this increases the underwriting cost and workload of the leasing company for no additional benefit. Similarly, an Associate with an abnormally high customer delinquency rate could indicate an underlying issue with affordability. This in turn places a burden on the leasing company’s collections and arrears management and could result in higher credit losses and the required provisioning. Conduct Risk perspective Does an Associate have a disproportionately high amount of lease contracts on minimum mileage compared to the channel baseline? Could they be writing business on minimum mileage to get the customer on the lowest monthly rental, disregarding the fact that the customer will then be hit with an excess mileage charge at the end of contract? For instance, the chart below shows that "Associate 1" has about four times the proportion of contracts on minimum mileage compared to the Associate channel average. If this is their standard practice in order to win business on the lowest monthly rental, this would be construed as miss-selling by the FCA and could result in the leasing company, not the Associate, being hit with a substantial fine. As mentioned in a previous article, accessing data across multiple systems at pace is important and this is also true here. Therefore, we created an interactive dashboard, fed by an automated process that pulled data from almost 20 different internal and external sources to provide comprehensive oversight on almost 200 brokers and dealers across the leasing company's nationwide network. The end result means that the leasing company now has swift and accurate data led governance and oversight which enables them to quickly identify and effectively manage both performance and compliance across their Associate channel. The next part of this series will talk more specifically about Data Analytics and Segmentation for sustainable growth. If you would like to know more, or to understand how you could use analytics to provide oversight across the business and third parties, then please contact us here to book a free Discovery consultation. Brendan JayagopalFounder & Managing Director. Blue Label Consulting. These are strange times. Times when managing your Risk becomes perhaps the most important aspect of your business (if it’s not already). Credit Risk In the current climate, it is not surprising that Credit risk exposure is at its highest since the last crisis. Therefore, having the analytical capability and capacity to tailor your credit decisioning approach to your business and customer base is critical. All too often we are seeing ‘off the shelf’ scorecards being used by businesses for underwriting and customer management. While this may make sense when in start-up mode when the business has little or none of its own performance data, its value as a risk predictor becomes less meaningful as time goes by, particularly when everything is changing at pace. It’s also not an option to drastically reduce or stop new business. As such, a more tailored approach to optimising the risk (and profit growth potential) of your portfolio needs to be developed. Taking this approach enables you to better inform your underwriting and customer management strategies and create more nuanced scorecards that are bespoke to your portfolio, enabling better underwriting as well as better customer and arrears management. As an example, we have developed bespoke application scorecards for the SME portfolio of a top vehicle leasing company in the UK. By switching to these new scorecards, they can expect to achieve a reduction of almost 16% in bad debt while maintaining current accept rates. Asset Risk Again, I firmly believe that it is difficult if not impossible to achieve competitive advantage using third party industry generic data. All players in Vehicle Leasing understand the importance of setting residual values (RVs) correctly. If set too high, it makes monthly rentals competitive but the Leasing Company realises a loss at the end of the contract. If set too low, you get a ‘theoretical’ good profit at the end of the contract but the monthly rental isn’t competitive, resulting in potential loss of business to competitors. If you set your RVs more accurately than your competitors, you get the advantage of having competitive pricing AND profitable lease contracts. And this is where applying machine learning for RV setting and pricing, as well as impairments forecasting, can help. Accessing new methodologies and data sources enable better forecasting, especially for electric vehicles where there is a limited amount of historical data but is crucial in the move to electrification. You can also consider whether this form of risk modelling might also inform potential improvements to the overall business model but that is another discussion. Recently, we applied machine learning to a leasing client’s own historical sales data to predict vehicle residual values (RV). Not only did the model identify and quantify pertinent RV risk drivers, it also gave them an empirical basis to challenge industry and manufacturer forecasts. One key finding was that for most of the popular vehicle models, the lifecycle adjustment of a well-known industry forecast was too pessimistic. As a result, RVs could have been set higher at inception to achieve a more competitive monthly rental while still being profitable. However you look at it, managing Risk in today’s environment is critically important to the health of any business but in particular, the Vehicle Leasing sector given the combined impact of both credit and asset risk. Innovative analytical methods such as Machine Learning and a mature analytics capability can play a key role in allowing businesses to continue to grow profitably. Given this, investment in analytical skills and resource should be a primary focus for any Risk oriented business. The next part of this series will talk more specifically about Governance and Oversight and how a strong data and analytics capability is essential to this. If you'd like to know more or to understand how we can help you take a more nuanced approach to managing risk, please contact us here to book your free Discovery consultation. Brendan JayagopalFounder & Managing Director. Blue Label Consulting |

brendan jayagopalBrendan launched Blue Label Consulting in 2011. With innovative use of Data through emerging data sciences such as AI and other quantitative methods, he delivers robust analytics and actionable insights to solve business problems. Archives

February 2021

Categories

All

|

Our Services |

Our Clients |

|

RSS Feed

RSS Feed