|

Driving Change and Sustainable Growth Over the course of this series, we have looked at how businesses can align their Data Analytics capabilities with business outcomes to drive Growth across a number of different areas. This is important as the Vehicle Leasing sector moves from the current downturn, to testing the market, to full on growth with a greater degree of certainty, safety and profitability. Data for Competitive Advantage Initially we looked at how data analytics can be a source of real competitive advantage particularly as you move away from over reliance on generic industry data and focus on the benefits of internal and proprietary data. I also talk briefly about this here - https://vimeo.com/423172464 In addition, speed is key in being able to access to the data, discover the insights and execute the strategy to get ahead of the competition. Managing Risk in Uncertain Times We also acknowledged that in these strange times – for Vehicle Leasing in particular – managing Risk becomes perhaps the most important aspect in your business (if it’s not already). As you look to open your doors to new business again, it’s important to develop your own credit scorecards based on customer performance rather than accessing generic scorecards. A more nuanced approach to assessing risk enables you to better inform new business underwriting as well as customer and arrears management strategies. Using your own data is also beneficial in setting Residual Values (RV), as was proven recently when we applied machine learning to a leasing client’s own historical sales data. Not only did the model identify and quantify pertinent RV risk drivers, it also gave them an empirical basis to challenge industry and manufacturer forecasts. Governance and Oversight Not the most exciting of topics, however this is a critical focus for companies in any form of financial services - or it should be. Having oversight of commercial performance and how sales are being achieved is clearly important for sales management, but equally, leasing companies need a method of safeguarding compliance by flagging up potential risks through comparative analysis across their Associate networks. Using data to oversee performance and pick up trends provides early warnings and helps ensure effective governance and management of the sales process across multiple outlets and channels across the network. New Business and Product Development As we come out the downturn and once again look to grow the business at pace, we need to be cognisant of the changes that have occurred. These may be minor changes or more fundamental ones such as customer behaviour, needs or circumstances. It is important that we understand how these impact the business and product offering. Employing analytics and machine learning techniques can reveal different segments and opportunities in your customer base and/or market place. This analysis can then be used to create more intelligently designed products and deliver them successfully to the target segments. Having the data and analytics capability to quickly identify these trends and then deriving actionable insight and acting on it will enable you to target your product development and sales and marketing activity more effectively and provide you with a stronger base for growth. Telematics For some Vehicle Leasing companies that also do insurance, Telematics data adds a whole new dimension to the risk assessment process, which leads to better pricing of premiums and increased profitability. Leasing companies that offer fleet management products or services on a consultancy basis can use the telematics data to help their clients’ own fleet managers achieve enhanced operational benefits. Doing more with Telematics data is a great way to gain competitive advantage so if you are not already doing it, you should. If you are, then are you doing all that you could to realise its full potential? Data as an Asset The key to pivoting your business for sustainable growth is to see Data as a mission critical business Asset. To get the most out of it, you need to invest in the data infrastructure and the teams that can extract actionable insight at pace. Businesses that have planned for different eventualities and used robust and comprehensive data analytics to make rapid, intelligent decisions and execute at pace will be best placed to survive and thrive beyond this crisis. Don’t get left behind. Take this opportunity to determine how to get the most out of your data assets whether that be through your own teams, accessing expert advice and support or a combination of both. In these difficult times, it is even more important to determine how to leverage your data to help you move to full on growth with certainty, safety and profitability. So What's Next? Having outlined how organisations can align their Data and Analytics capabilities with business outcomes to drive Growth across different areas, there are a number of steps you should take now in order to build resilience and prepare for recovery. If you haven't already, start by reviewing the data and models used to inform key business decisions. Prioritise by importance and materiality then work your way down the list, reviewing aspects such as:

Start researching how you can use additional and/or alternative data sources to improve existing models and build new ones. If you're not already, you need to capitalise on transactional data to give you a more granular understanding of customer behaviour. Can you create more proprietary data by combining internal/external data with data that your business generates? If you can, you should also undertake some form of sentiment analysis e.g. using social media data where appropriate. Also, make sure you consider how digital transformation can impact your business both in terms of opportunities as well as risks such as fraud or data security. It is estimated that this crisis has accelerated digital transformation by 7 years! So if you've not already done it, you soon will and you'll need to be ready for it. Recognise Opportunities and Adapt Finally, keep in mind that this is not just about avoiding risk but also about recognising opportunities and adapting quickly. Therefore, it's also crucial to be aware of technical and system implications of the data and models you wish to develop and deploy as well as the ability of your systems and people to support the strategy you wish to execute. Remember that more often than not, speed of execution is key and this will determine the winners and losers emerging from this crisis. If you are interested in finding out more about how we can help you to build resilience in these uncertain times and position your business for growth, please contact us here to book your free Discovery consultation. Blue Label Consulting Approach An independent Data Science and Analytics consultancy operating in Vehicle Leasing and Financial Services, Blue Label Consulting delivers valuable, actionable and strategic insight while making knowledge transfer to your team a priority. Whether in Asset Risk or Credit Risk, Segmentation and Customer Insight or Governance and Oversight, we can help you solve your data related business challenges and help your data teams become self-sufficient in the long run. Brendan JayagopalFounder & Managing Director. Blue Label Consulting

0 Comments

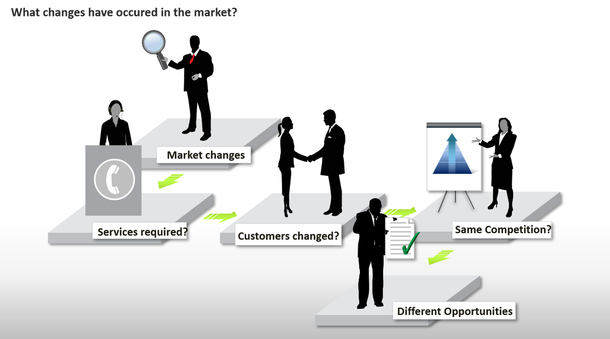

After months of restrictions, many businesses are trying to determine how to return to growth after battening down the hatches for so long. But where do you start? What is it that now makes your business vulnerable and how do you place your business on a competitive footing going forward?  While I hate the phrase ‘new normal’, it is clear that almost every business has been taking stock of where they are financially, operationally and competitively. But once you have an understanding of your situation and the broader market dynamics, what next? Each business has reacted differently to changes in the market with many having limited or even stopped sales activity. And to determine how to turn the situation around you need to know what changes have occurred.

Identifying opportunities As you look to go beyond the basics of opening up your sales and marketing operations, you should look to your Analytics teams for guidance. Ask them to provide the data and insight needed to expand activities profitably and to determine where new market and product opportunities are that perhaps weren’t around or strategically important before. Have new markets or segments opened up that you can serve with your current product offering and operational capabilities? What difficulties are the competition facing (or indeed threats to yourselves) that you can identify and react to? There may even be consolidation in the industry, which could lead to opportunities to acquire competitors’ assets to rapidly grow market share. Employing machine learning techniques can reveal different segments and opportunities in your customer base and/or market place. This analysis can then be used to create more intelligently designed products and deliver them successfully to your target segments. This holds true for new customer acquisition as well as customer retention and yield management of your own customer base. Can your data analytics team identify any new or underserved segments that with a little thought around your product design, you could quickly access and grow market share? As post crisis markets continue to re-baseline, the structure of products is also likely to drastically change and vehicle leasing companies need to recalibrate to this new baseline. As an example, could subscription based products appeal to more consumers than before? A segmentation exercise could determine this by identifying the profile, needs and expectations of customers allowing you to create new product characteristics such as:

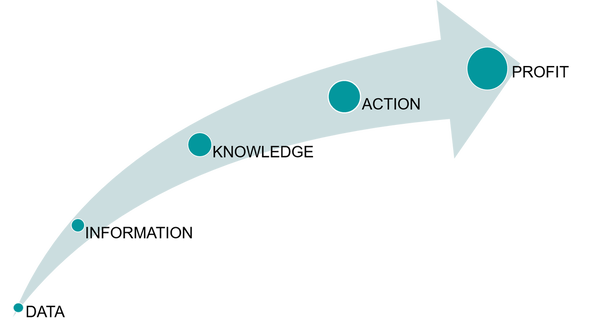

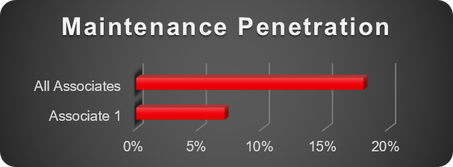

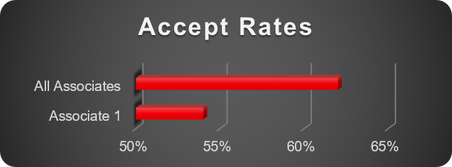

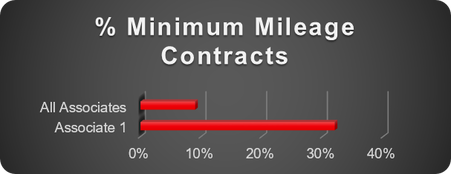

Having the data and analytics capability to identify these segments and then deriving actionable insight to capitalise on the underlying trends will enable you to target your product development and sales and marketing activity more effectively and provide you with a stronger base for growth. The next part of this series will talk more specifically about Telematics opportunities. If you want to know how to use data analytics for sustainable growth in the current climate and beyond, please contact us here to book your free Discovery consultation. Brendan JayagopalFounder & Managing Director. Blue Label Consulting.  Governance and Oversight Governance and Oversight, or compliance if you will. Not the most exciting of topics and not immediately obvious as a data analytics subject matter. However, it is a critical focus across the financial services industry and so it should be in the Vehicle Leasing sector. So how can we use data analytics to help ensure that we have oversight across the business and third parties as appropriate? And why is this important? In order to bring this to life, I will use an example focussing on third party associate (broker/dealer) oversight. Having a clear view of commercial performance and how it is being achieved is vitally important for sales management. Equally, leasing companies need a method of ensuring compliant sales and flagging up potential risks through comparative analysis across their Associate channel. Identifying the data requirements is therefore as important as pulling it together into a visual and accessible format for stakeholders to self-serve. The areas of oversight we need to look at therefore include: Commercial performance Key metrics monitored include tracking against sales targets, tactical sales, early terminations, penetration of add on services, contribution, as well as commission and VRB. Monitoring these metrics informs the respective account managers of conversations they might need to be having with their associates. For instance, if a given associate is overly reliant on tactical sales or not selling enough add on services, such as shown by “Associate 1” below, whose maintenance penetration is about a third that of the entire Associate channel. These metrics could be used to decide on which levers to pull to influence Associate behaviour e.g. offering better VRB terms, increased sales support if over reliant on tactical sales or better commission. Responsible lending Credit quality of customers put forward by Associates has to be closely monitored to determine the quality of their credit decisioning process, including affordability assessments. Does every Associate undertake the necessary checks to pre-qualify a customer to see if they can afford the monthly rentals and are credit worthy? For example, the Accept rate of “Associate 1” in the chart below is markedly lower than that of the Associate channel average. This low accept rate could indicate that they are not doing enough to pre-qualify prospective customers before submission. Coupled with a high refer rate, this increases the underwriting cost and workload of the leasing company for no additional benefit. Similarly, an Associate with an abnormally high customer delinquency rate could indicate an underlying issue with affordability. This in turn places a burden on the leasing company’s collections and arrears management and could result in higher credit losses and the required provisioning. Conduct Risk perspective Does an Associate have a disproportionately high amount of lease contracts on minimum mileage compared to the channel baseline? Could they be writing business on minimum mileage to get the customer on the lowest monthly rental, disregarding the fact that the customer will then be hit with an excess mileage charge at the end of contract? For instance, the chart below shows that "Associate 1" has about four times the proportion of contracts on minimum mileage compared to the Associate channel average. If this is their standard practice in order to win business on the lowest monthly rental, this would be construed as miss-selling by the FCA and could result in the leasing company, not the Associate, being hit with a substantial fine. As mentioned in a previous article, accessing data across multiple systems at pace is important and this is also true here. Therefore, we created an interactive dashboard, fed by an automated process that pulled data from almost 20 different internal and external sources to provide comprehensive oversight on almost 200 brokers and dealers across the leasing company's nationwide network. The end result means that the leasing company now has swift and accurate data led governance and oversight which enables them to quickly identify and effectively manage both performance and compliance across their Associate channel. The next part of this series will talk more specifically about Data Analytics and Segmentation for sustainable growth. If you would like to know more, or to understand how you could use analytics to provide oversight across the business and third parties, then please contact us here to book a free Discovery consultation. Brendan JayagopalFounder & Managing Director. Blue Label Consulting. The Transformative Power of Data I make no apologies for repeating the following quote from Equinox CIO Milind Wagle... “Data and analytics (is) more important than ever. You’re making decisions daily with changing information and reacting to factors outside your control.” This becomes even more critical in times of uncertainty. The value and transformative power of data and analytics should not be a secret to anyone these days but all too often, insufficient focus and investment is given to enable businesses to realise the value from the resource they already have. The Importance of Speed Unfortunately, while many businesses have reasonable data infrastructures they are often frustrated by their inability to deep dive into the data. Often when the data is there, the business cannot access it quickly enough to draw out insights that they can act on in a timely manner. Even when you have limitations in your existing data infrastructures you need to find ways to speed up access to your own data. Management need to know how the business is doing today, not how it was doing 3 weeks ago! Over reliance on 3rd party and industry generic data Then there are businesses that have an over or sole reliance on industry generic data and make decisions based solely on that generic information. This is particularly true in the Vehicle Leasing sector. As a result, those businesses simply cannot gain any real competitive advantage as their decisions are based on generic data which, while useful, is not specifically tailored to their business or their customer base. It makes sense therefore for businesses to look at how they can leverage their own internal data. This doesn’t mean ignoring industry data. Indeed using it to enrich your own data can add real value but it is this combination coupled with the analytical capability to rapidly extract actionable insight on an ongoing basis that counts. Creating and using Proprietary Data To create additional advantage you should also seek to leverage proprietary data. By this, I mean data that is unique to your business. And you might ask whether this is simply the same as internal data. It isn’t. Internal data may or may not be unique to you and while all internal data is valuable, it is the unique elements that potentially have the greatest value. In fleet management you will have internal vehicle data but then your competitors will also have the same basic data. So you need to find the specific data that is different and only accessible by you. For example, if you combine your specific Telematics data with your basic vehicle data then this combination creates a valuable proprietary data asset which you can use to deliver operational benefits such as maximising asset up time, pre-emptive maintenance and better cost management. Perhaps not the most exciting but incredibly valuable. The world is changing. Relevant, good quality data coupled with the ability to mine and extract insights is key to understanding the impact these changes will have on your business and finding the opportunities they present. Data and analytics can be transformative. Understanding what you have, analysing your data at speed and making the resultant insights accessible is key to creating real value and competitive advantage. The next part of this series will talk more specifically managing Risk in uncertain times. If you want to know more about the transformative power of data or indeed have a project that you need support with, we’d be delighted to offer you a free Discovery consultation. If you’re open to that, please click here to contact us and we’ll be in touch to schedule a call. Brendan JayagopalFounder & Managing Director. Blue Label Consulting |

brendan jayagopalBrendan launched Blue Label Consulting in 2011. With innovative use of Data through emerging data sciences such as AI and other quantitative methods, he delivers robust analytics and actionable insights to solve business problems. Archives

February 2021

Categories

All

|

Our Services |

Our Clients |

|

RSS Feed

RSS Feed