|

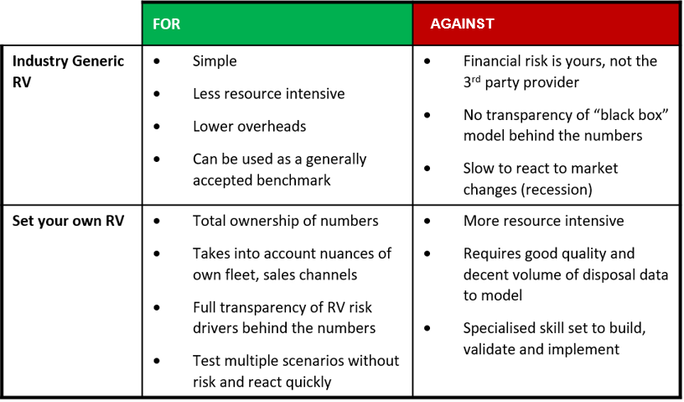

These are strange times. Times when managing your Risk becomes perhaps the most important aspect of your business (if it’s not already). Credit Risk In the current climate, it is not surprising that Credit risk exposure is at its highest since the last crisis. Therefore, having the analytical capability and capacity to tailor your credit decisioning approach to your business and customer base is critical. All too often we are seeing ‘off the shelf’ scorecards being used by businesses for underwriting and customer management. While this may make sense when in start-up mode when the business has little or none of its own performance data, its value as a risk predictor becomes less meaningful as time goes by, particularly when everything is changing at pace. It’s also not an option to drastically reduce or stop new business. As such, a more tailored approach to optimising the risk (and profit growth potential) of your portfolio needs to be developed. Taking this approach enables you to better inform your underwriting and customer management strategies and create more nuanced scorecards that are bespoke to your portfolio, enabling better underwriting as well as better customer and arrears management. As an example, we have developed bespoke application scorecards for the SME portfolio of a top vehicle leasing company in the UK. By switching to these new scorecards, they can expect to achieve a reduction of almost 16% in bad debt while maintaining current accept rates. Asset Risk Again, I firmly believe that it is difficult if not impossible to achieve competitive advantage using third party industry generic data. All players in Vehicle Leasing understand the importance of setting residual values (RVs) correctly. If set too high, it makes monthly rentals competitive but the Leasing Company realises a loss at the end of the contract. If set too low, you get a ‘theoretical’ good profit at the end of the contract but the monthly rental isn’t competitive, resulting in potential loss of business to competitors. If you set your RVs more accurately than your competitors, you get the advantage of having competitive pricing AND profitable lease contracts. And this is where applying machine learning for RV setting and pricing, as well as impairments forecasting, can help. Accessing new methodologies and data sources enable better forecasting, especially for electric vehicles where there is a limited amount of historical data but is crucial in the move to electrification. You can also consider whether this form of risk modelling might also inform potential improvements to the overall business model but that is another discussion. Recently, we applied machine learning to a leasing client’s own historical sales data to predict vehicle residual values (RV). Not only did the model identify and quantify pertinent RV risk drivers, it also gave them an empirical basis to challenge industry and manufacturer forecasts. One key finding was that for most of the popular vehicle models, the lifecycle adjustment of a well-known industry forecast was too pessimistic. As a result, RVs could have been set higher at inception to achieve a more competitive monthly rental while still being profitable. However you look at it, managing Risk in today’s environment is critically important to the health of any business but in particular, the Vehicle Leasing sector given the combined impact of both credit and asset risk. Innovative analytical methods such as Machine Learning and a mature analytics capability can play a key role in allowing businesses to continue to grow profitably. Given this, investment in analytical skills and resource should be a primary focus for any Risk oriented business. The next part of this series will talk more specifically about Governance and Oversight and how a strong data and analytics capability is essential to this. If you'd like to know more or to understand how we can help you take a more nuanced approach to managing risk, please contact us here to book your free Discovery consultation. Brendan JayagopalFounder & Managing Director. Blue Label Consulting

3 Comments

|

brendan jayagopalBrendan launched Blue Label Consulting in 2011. With innovative use of Data through emerging data sciences such as AI and other quantitative methods, he delivers robust analytics and actionable insights to solve business problems. Archives

February 2021

Categories

All

|

Our Services |

Our Clients |

|

RSS Feed

RSS Feed