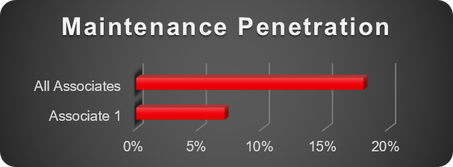

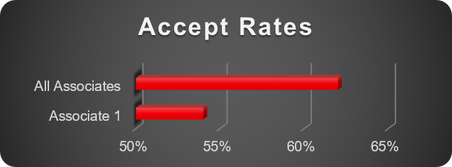

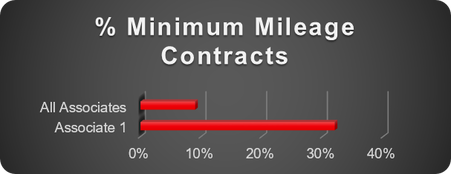

Governance and Oversight Governance and Oversight, or compliance if you will. Not the most exciting of topics and not immediately obvious as a data analytics subject matter. However, it is a critical focus across the financial services industry and so it should be in the Vehicle Leasing sector. So how can we use data analytics to help ensure that we have oversight across the business and third parties as appropriate? And why is this important? In order to bring this to life, I will use an example focussing on third party associate (broker/dealer) oversight. Having a clear view of commercial performance and how it is being achieved is vitally important for sales management. Equally, leasing companies need a method of ensuring compliant sales and flagging up potential risks through comparative analysis across their Associate channel. Identifying the data requirements is therefore as important as pulling it together into a visual and accessible format for stakeholders to self-serve. The areas of oversight we need to look at therefore include: Commercial performance Key metrics monitored include tracking against sales targets, tactical sales, early terminations, penetration of add on services, contribution, as well as commission and VRB. Monitoring these metrics informs the respective account managers of conversations they might need to be having with their associates. For instance, if a given associate is overly reliant on tactical sales or not selling enough add on services, such as shown by “Associate 1” below, whose maintenance penetration is about a third that of the entire Associate channel. These metrics could be used to decide on which levers to pull to influence Associate behaviour e.g. offering better VRB terms, increased sales support if over reliant on tactical sales or better commission. Responsible lending Credit quality of customers put forward by Associates has to be closely monitored to determine the quality of their credit decisioning process, including affordability assessments. Does every Associate undertake the necessary checks to pre-qualify a customer to see if they can afford the monthly rentals and are credit worthy? For example, the Accept rate of “Associate 1” in the chart below is markedly lower than that of the Associate channel average. This low accept rate could indicate that they are not doing enough to pre-qualify prospective customers before submission. Coupled with a high refer rate, this increases the underwriting cost and workload of the leasing company for no additional benefit. Similarly, an Associate with an abnormally high customer delinquency rate could indicate an underlying issue with affordability. This in turn places a burden on the leasing company’s collections and arrears management and could result in higher credit losses and the required provisioning. Conduct Risk perspective Does an Associate have a disproportionately high amount of lease contracts on minimum mileage compared to the channel baseline? Could they be writing business on minimum mileage to get the customer on the lowest monthly rental, disregarding the fact that the customer will then be hit with an excess mileage charge at the end of contract? For instance, the chart below shows that "Associate 1" has about four times the proportion of contracts on minimum mileage compared to the Associate channel average. If this is their standard practice in order to win business on the lowest monthly rental, this would be construed as miss-selling by the FCA and could result in the leasing company, not the Associate, being hit with a substantial fine. As mentioned in a previous article, accessing data across multiple systems at pace is important and this is also true here. Therefore, we created an interactive dashboard, fed by an automated process that pulled data from almost 20 different internal and external sources to provide comprehensive oversight on almost 200 brokers and dealers across the leasing company's nationwide network. The end result means that the leasing company now has swift and accurate data led governance and oversight which enables them to quickly identify and effectively manage both performance and compliance across their Associate channel. The next part of this series will talk more specifically about Data Analytics and Segmentation for sustainable growth. If you would like to know more, or to understand how you could use analytics to provide oversight across the business and third parties, then please contact us here to book a free Discovery consultation. Brendan JayagopalFounder & Managing Director. Blue Label Consulting.

0 Comments

Leave a Reply. |

brendan jayagopalBrendan launched Blue Label Consulting in 2011. With innovative use of Data through emerging data sciences such as AI and other quantitative methods, he delivers robust analytics and actionable insights to solve business problems. Archives

February 2021

Categories

All

|

Our Services |

Our Clients |

|

RSS Feed

RSS Feed