|

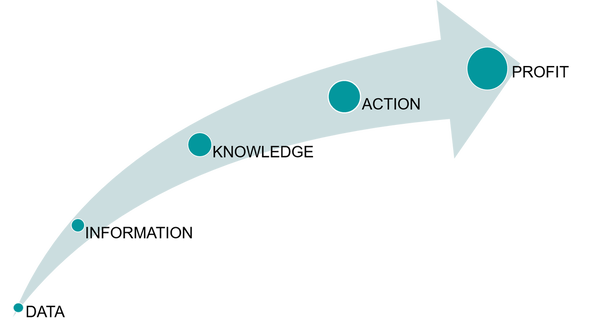

Driving Change and Sustainable Growth Over the course of this series, we have looked at how businesses can align their Data Analytics capabilities with business outcomes to drive Growth across a number of different areas. This is important as the Vehicle Leasing sector moves from the current downturn, to testing the market, to full on growth with a greater degree of certainty, safety and profitability. Data for Competitive Advantage Initially we looked at how data analytics can be a source of real competitive advantage particularly as you move away from over reliance on generic industry data and focus on the benefits of internal and proprietary data. I also talk briefly about this here - https://vimeo.com/423172464 In addition, speed is key in being able to access to the data, discover the insights and execute the strategy to get ahead of the competition. Managing Risk in Uncertain Times We also acknowledged that in these strange times – for Vehicle Leasing in particular – managing Risk becomes perhaps the most important aspect in your business (if it’s not already). As you look to open your doors to new business again, it’s important to develop your own credit scorecards based on customer performance rather than accessing generic scorecards. A more nuanced approach to assessing risk enables you to better inform new business underwriting as well as customer and arrears management strategies. Using your own data is also beneficial in setting Residual Values (RV), as was proven recently when we applied machine learning to a leasing client’s own historical sales data. Not only did the model identify and quantify pertinent RV risk drivers, it also gave them an empirical basis to challenge industry and manufacturer forecasts. Governance and Oversight Not the most exciting of topics, however this is a critical focus for companies in any form of financial services - or it should be. Having oversight of commercial performance and how sales are being achieved is clearly important for sales management, but equally, leasing companies need a method of safeguarding compliance by flagging up potential risks through comparative analysis across their Associate networks. Using data to oversee performance and pick up trends provides early warnings and helps ensure effective governance and management of the sales process across multiple outlets and channels across the network. New Business and Product Development As we come out the downturn and once again look to grow the business at pace, we need to be cognisant of the changes that have occurred. These may be minor changes or more fundamental ones such as customer behaviour, needs or circumstances. It is important that we understand how these impact the business and product offering. Employing analytics and machine learning techniques can reveal different segments and opportunities in your customer base and/or market place. This analysis can then be used to create more intelligently designed products and deliver them successfully to the target segments. Having the data and analytics capability to quickly identify these trends and then deriving actionable insight and acting on it will enable you to target your product development and sales and marketing activity more effectively and provide you with a stronger base for growth. Telematics For some Vehicle Leasing companies that also do insurance, Telematics data adds a whole new dimension to the risk assessment process, which leads to better pricing of premiums and increased profitability. Leasing companies that offer fleet management products or services on a consultancy basis can use the telematics data to help their clients’ own fleet managers achieve enhanced operational benefits. Doing more with Telematics data is a great way to gain competitive advantage so if you are not already doing it, you should. If you are, then are you doing all that you could to realise its full potential? Data as an Asset The key to pivoting your business for sustainable growth is to see Data as a mission critical business Asset. To get the most out of it, you need to invest in the data infrastructure and the teams that can extract actionable insight at pace. Businesses that have planned for different eventualities and used robust and comprehensive data analytics to make rapid, intelligent decisions and execute at pace will be best placed to survive and thrive beyond this crisis. Don’t get left behind. Take this opportunity to determine how to get the most out of your data assets whether that be through your own teams, accessing expert advice and support or a combination of both. In these difficult times, it is even more important to determine how to leverage your data to help you move to full on growth with certainty, safety and profitability. So What's Next? Having outlined how organisations can align their Data and Analytics capabilities with business outcomes to drive Growth across different areas, there are a number of steps you should take now in order to build resilience and prepare for recovery. If you haven't already, start by reviewing the data and models used to inform key business decisions. Prioritise by importance and materiality then work your way down the list, reviewing aspects such as:

Start researching how you can use additional and/or alternative data sources to improve existing models and build new ones. If you're not already, you need to capitalise on transactional data to give you a more granular understanding of customer behaviour. Can you create more proprietary data by combining internal/external data with data that your business generates? If you can, you should also undertake some form of sentiment analysis e.g. using social media data where appropriate. Also, make sure you consider how digital transformation can impact your business both in terms of opportunities as well as risks such as fraud or data security. It is estimated that this crisis has accelerated digital transformation by 7 years! So if you've not already done it, you soon will and you'll need to be ready for it. Recognise Opportunities and Adapt Finally, keep in mind that this is not just about avoiding risk but also about recognising opportunities and adapting quickly. Therefore, it's also crucial to be aware of technical and system implications of the data and models you wish to develop and deploy as well as the ability of your systems and people to support the strategy you wish to execute. Remember that more often than not, speed of execution is key and this will determine the winners and losers emerging from this crisis. If you are interested in finding out more about how we can help you to build resilience in these uncertain times and position your business for growth, please contact us here to book your free Discovery consultation. Blue Label Consulting Approach An independent Data Science and Analytics consultancy operating in Vehicle Leasing and Financial Services, Blue Label Consulting delivers valuable, actionable and strategic insight while making knowledge transfer to your team a priority. Whether in Asset Risk or Credit Risk, Segmentation and Customer Insight or Governance and Oversight, we can help you solve your data related business challenges and help your data teams become self-sufficient in the long run. Brendan JayagopalFounder & Managing Director. Blue Label Consulting

0 Comments

Leave a Reply. |

brendan jayagopalBrendan launched Blue Label Consulting in 2011. With innovative use of Data through emerging data sciences such as AI and other quantitative methods, he delivers robust analytics and actionable insights to solve business problems. Archives

February 2021

Categories

All

|

Our Services |

Our Clients |

|

RSS Feed

RSS Feed